Industry-specific ecosystems are revolutionizing the way startups and investors approach markets. In this article, we delve into why these ecosystems are pivotal and how ICARUS Ventures is smartly investing in the burgeoning sectors of Insurtech and Fintech.

Why Insurtech and Fintech?

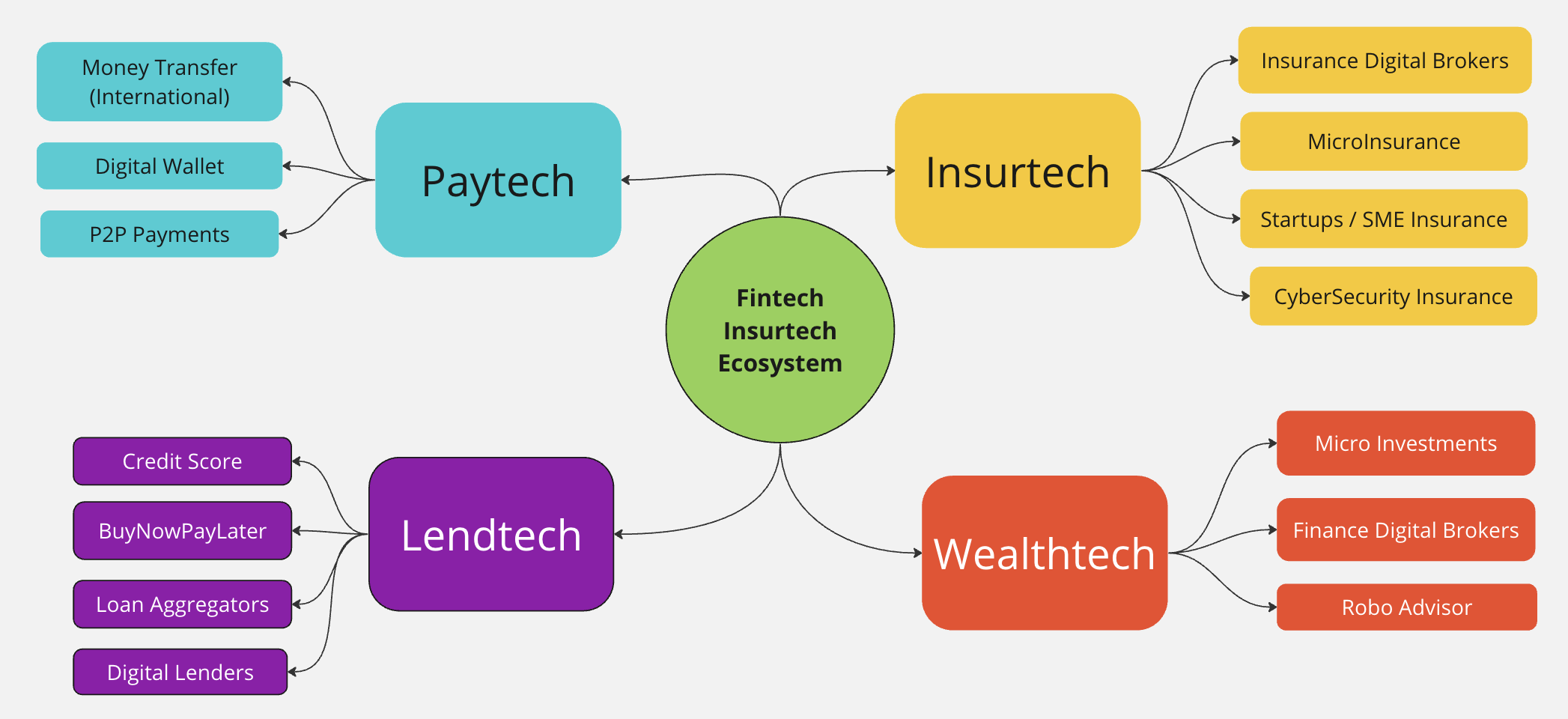

The untapped potential in both Insurtech and Fintech sectors is immense. The key lies in the still-available market space for developing solutions that add real value to the end customer. At ICARUS Ventures, we see a golden opportunity to invest in these nascent yet promising sectors. The market is ripe for disruption, and we are positioning ourselves to be at the forefront of this change.

What is the Ecosystem for us:

The Power of Synergy

The synergy between Insurtech and Fintech is both natural and synchronous. The challenge lies in connecting the right dots to streamline communication among the necessary stakeholders. This not only enhances the experience for the companies involved but also ensures that the insured receive a high-level experience. By integrating advanced technologies and innovative solutions, we aim to create a seamless flow of services that benefit everyone in the ecosystem.

Investment Philosophy

Our investment philosophy revolves around the concept of “smart money,” which means we provide more than just capital. We offer administrative support, technology, and marketing expertise from a founder-friendly perspective. We focus on early stages—Angel, PreSeed, and Seed—and only invest in specific sectors like Fintech, Insurtech, Healthtech, and especially SaaS that involve AI or have the potential for its application.

Real-world Examples

We have invested in startups like LISA Insurtech, BELLA Twin, and Acameaseguro.com, scaling these companies from zero to one in an average span of three years. These investments serve as case studies that validate our investment thesis and strategy.

Challenges and Solutions

The most significant challenges include a lack of industry knowledge and poor communication among ecosystem stakeholders. As active, hands-on partners, we are here to overcome these hurdles. We consider ourselves doers rather than talkers, more as a useful resource than just a board member who audits. We help build value and scale.

The Role of Advisors and Partners

Being an active partner is more than being a board member who audits; it’s being a useful resource that helps build value and scale. Choosing the right advisors and partners can make or break our investment strategy. We are highly selective in this regard to ensure that we align ourselves with individuals and firms that share our vision and operational ethos.

Future Outlook

We are in the midst of a significant technological shift. Our focus is to invest in the most cutting-edge technology players and scale them to average valuations of over USD $30 million each in less than three years. We plan to invest in 20 companies in the next two years, focusing on LATAM and USA and then scaling them to the U.S. market.

Conclusion

Industry-specific ecosystems like Insurtech and Fintech offer unprecedented opportunities for startups and investors alike. We invite you to join us on this exciting journey.

Last but not least.

If you’re interested in being part of this exciting ecosystem, feel free to send us your deck for potential investment here.